OldCobber46

Germinating

- User ID

- 641

i have been trading global markets for almost 25 years, well before internet trading evolved to what it is today.

Best CHESS broker: selfwealth.com.au

avoid non chess brokers because if they go belly up (remember opus prime?) your money and shares are gone

Investment and daily income generation guide:

Go long on stocks with low p/e and solid balance sheets that show growth. Make a shortlist of these you would like to own. Obtain these stocks by only buying on days the market is down, accumulute only parcels at a time, so if it eeps dropping your average buy in price goes lower. Eg if you want to buy 1000 shares of say, ANZ bank, buy 200 at a time trying to average down the price.

Once you have a portfolio, use a low cost broker to trade it every day. Sell and buy back lower the same day if possible, intraday if necessary. Same principle, don't sell all at once, stagger the sales to ride the price if the market is going up. Be careful trading stocks near ex dividend date as they usually run up in value and you may not be abke to buy them back for a lower price.

Many stocks offer 1% or more price movements during a day. While its near impossible to guess right every time, a good trader can average between .25% and .5% a day. If you hit .5% a day, that is 2.5% a week, so on 100k that is $2500 profit, easily enough to live on!

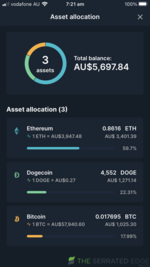

Oh, and avoid meme stocks and crypto unless you are a pure gambler. There is a difference between investment and gambling!

Best CHESS broker: selfwealth.com.au

avoid non chess brokers because if they go belly up (remember opus prime?) your money and shares are gone

Investment and daily income generation guide:

Go long on stocks with low p/e and solid balance sheets that show growth. Make a shortlist of these you would like to own. Obtain these stocks by only buying on days the market is down, accumulute only parcels at a time, so if it eeps dropping your average buy in price goes lower. Eg if you want to buy 1000 shares of say, ANZ bank, buy 200 at a time trying to average down the price.

Once you have a portfolio, use a low cost broker to trade it every day. Sell and buy back lower the same day if possible, intraday if necessary. Same principle, don't sell all at once, stagger the sales to ride the price if the market is going up. Be careful trading stocks near ex dividend date as they usually run up in value and you may not be abke to buy them back for a lower price.

Many stocks offer 1% or more price movements during a day. While its near impossible to guess right every time, a good trader can average between .25% and .5% a day. If you hit .5% a day, that is 2.5% a week, so on 100k that is $2500 profit, easily enough to live on!

Oh, and avoid meme stocks and crypto unless you are a pure gambler. There is a difference between investment and gambling!